If the continuous oil price increases do not stop in the succeeding months, the suspension of excise taxes might be put on the table.

Senator Sherwin Gatchalian, the incoming chairman of the Senate Ways and Means Committee, said that should the persistent high fuel prices extend in the next 6-12 months, it may make the suspension of excise taxes possible.

“If this will be prolonged, if this will extend for the next 6-12 months then that (suspension of excise taxes) is on the table right now,” he said, looking to also suspend VAT if necessary.

“But I think excise tax is easier to administer than VAT. But on a matter of principle, I’m also open to looking at that if the situation gets prolonged,” the senator added.

With the temporary scrapping of the excise taxes for petroleum commodities, Filipino consumers may immediately benefit from P10.00/liter price cuts for gasoline, P6.00/liter price cut for diesel, and up to P5.00/liter price cut for kerosene products.

Gatchalian opined that the existing fuel subsidies can only help public utility drivers, as well as the fishermen in terms of direct subsidies, leaving the middle class sector to still have budget complications, since having their private vehicles, they also have businesses that require the use of fuel.

“It’s better to talk about this in the hearing so it will be formal and we will get all the data together. I think the bottom line here is: we have to expect for the worst in a prolonged scenario,” the lawmaker stressed.

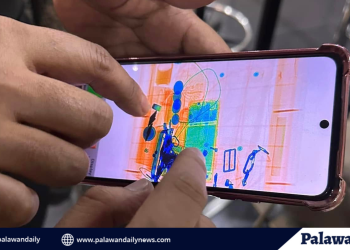

In Puerto Princesa City and the province of Palawan, fuel prices are now expected to breach P100.00/liter, anticipating the continuous increase in fuel prices due to the world market situation.

Discussion about this post